Page 15 - F6 Slide - VAT Part 2 - Lecture Day 5

P. 15

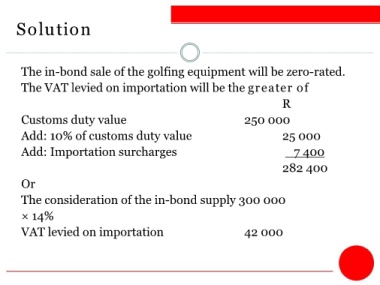

Solution

The in-bond sale of the golfing equipment will be zero-rated.

The VAT levied on importation will be the greater of

R

Customs duty value 250 000

Add: 10% of customs duty value 25 000

Add: Importation surcharges 7 400

282 400

Or

The consideration of the in-bond supply 300 000

× 14%

VAT levied on importation 42 000