Page 17 - F6 Slide - VAT Part 2 - Lecture Day 5

P. 17

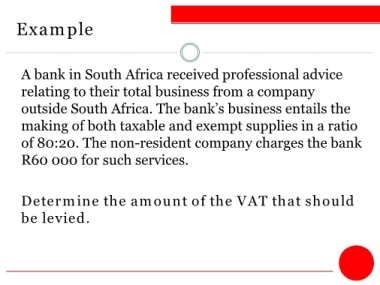

Example

A bank in South Africa received professional advice

relating to their total business from a company

outside South Africa. The bank’s business entails the

making of both taxable and exempt supplies in a ratio

of 80:20. The non-resident company charges the bank

R60 000 for such services.

Determine the amount of the VAT that should

be levied.