Page 105 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 105

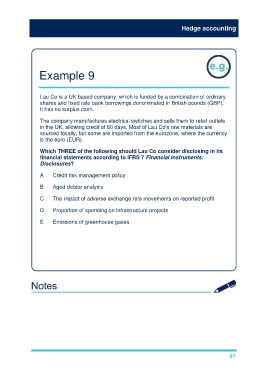

Hedge accounting

Example 9

Lau Co is a UK based company, which is funded by a combination of ordinary

shares and fixed rate bank borrowings denominated in British pounds (GBP).

It has no surplus cash.

The company manufactures electrical switches and sells them to retail outlets

in the UK, allowing credit of 60 days. Most of Lau Co's raw materials are

sourced locally, but some are imported from the eurozone, where the currency

is the euro (EUR).

Which THREE of the following should Lau Co consider disclosing in its

financial statements according to IFRS 7 Financial Instruments:

Disclosures?

A Credit risk management policy

B Aged debtor analysis

C The impact of adverse exchange rate movements on reported profit

D Proportion of spending on infrastructure projects

E Emissions of greenhouse gases

Solution

The answer is (A), (B) and (C).

(D) and (E) would be disclosed in a sustainability report following the GRI G4

guidelines. They are not required by IFRS 7.

97