Page 131 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 131

Financing – Debt finance

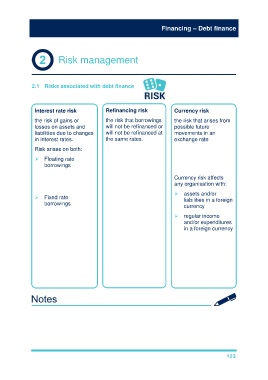

Risk management

2.1 Risks associated with debt finance

Interest rate risk Refinancing risk Currency risk

the risk of gains or the risk that borrowings the risk that arises from

losses on assets and will not be refinanced or possible future

liabilities due to changes will not be refinanced at movements in an

in interest rates. the same rates. exchange rate

Risk arises on both: Three causes: (a two way risk –

exchange rates can

Floating rate lenders are move either adversely

borrowings unwilling to lend or or favourably)

only prepared to

– changes in interest lend at higher rates Currency risk affects

rates alter the amount of any organisation with:

interest payable. the credit rating of

the company has assets and/or

Fixed rate

reduced making it a liabilities in a foreign

borrowings more unattractive currency

– even though interest lending option

charges themselves will regular income

not change, a fixed rate the company may and/or expenditures

can make a company need to refinance in a foreign currency

quickly and

uncompetitive if its costs therefore have However, even if a

are higher than those difficulty in company does not deal

with a floating rate and obtaining the best in any currencies, it will

interest rates fall. rates. still face a risk since its

competitors may be

faring better due to

favourable exchange

rates.

123