Page 138 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 138

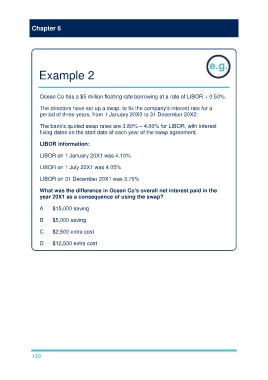

Chapter 6

Example 2

Ocean Co has a $5 million floating rate borrowing at a rate of LIBOR + 0.50%.

The directors have set up a swap, to fix the company's interest rate for a

period of three years, from 1 January 20X0 to 31 December 20X2.

The bank's quoted swap rates are 3.80% – 4.00% for LIBOR, with interest

fixing dates on the start date of each year of the swap agreement.

LIBOR information:

LIBOR on 1 January 20X1 was 4.10%

LIBOR on 1 July 20X1 was 4.05%

LIBOR on 31 December 20X1 was 3.75%

What was the difference in Ocean Co's overall net interest paid in the

year 20X1 as a consequence of using the swap?

A $15,000 saving

B $5,000 saving

C $2,500 extra cost

D $12,500 extra cost

130