Page 152 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 152

Chapter 6

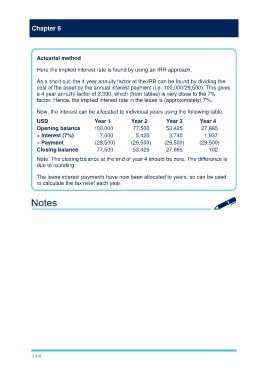

Actuarial method

Here the implied interest rate is found by using an IRR approach.

As a short cut, the 4 year annuity factor at the IRR can be found by dividing the

cost of the asset by the annual interest payment (i.e. 100,000/29,500). This gives

a 4 year annuity factor of 3.390, which (from tables) is very close to the 7%

factor. Hence, the implied interest rate in the lease is (approximately) 7%.

Now, the interest can be allocated to individual years using the following table:

USD Year 1 Year 2 Year 3 Year 4

Opening balance 100,000 77,500 53,425 27,665

+ Interest (7%) 7,000 5,425 3,740 1,937

– Payment (29,500) (29,500) (29,500) (29,500)

Closing balance 77,500 53,425 27,665 102

Note: The closing balance at the end of year 4 should be zero. The difference is

due to rounding.

The lease interest payments have now been allocated to years, so can be used

to calculate the tax relief each year.

144