Page 153 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 153

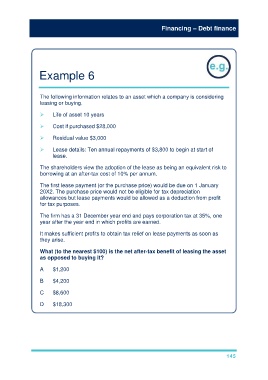

Financing – Debt finance

Example 6

The following information relates to an asset which a company is considering

leasing or buying.

Life of asset 10 years

Cost if purchased $28,000

Residual value $3,000

Lease details: Ten annual repayments of $3,800 to begin at start of

lease.

The shareholders view the adoption of the lease as being an equivalent risk to

borrowing at an after-tax cost of 10% per annum.

The first lease payment (or the purchase price) would be due on 1 January

20X2. The purchase price would not be eligible for tax depreciation

allowances but lease payments would be allowed as a deduction from profit

for tax purposes.

The firm has a 31 December year end and pays corporation tax at 35%, one

year after the year end in which profits are earned.

It makes sufficient profits to obtain tax relief on lease payments as soon as

they arise.

What (to the nearest $100) is the net after-tax benefit of leasing the asset

as opposed to buying it?

A $1,200

B $4,200

C $8,600

D $18,300

145