Page 172 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 172

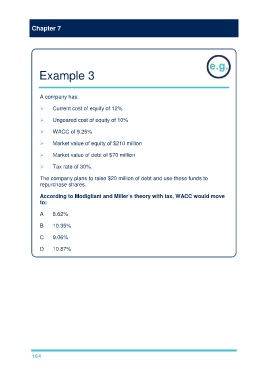

Chapter 7

Example 3

A company has:

Current cost of equity of 12%

Ungeared cost of equity of 10%

WACC of 9.25%

Market value of equity of $210 million

Market value of debt of $70 million

Tax rate of 30%.

The company plans to raise $20 million of debt and use these funds to

repurchase shares.

According to Modigliani and Miller’s theory with tax, WACC would move

to:

A 8.62%

B 10.35%

C 9.06%

D 10.87%

164