Page 177 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 177

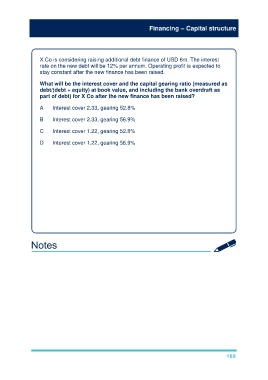

Financing – Capital structure

X Co is considering raising additional debt finance of USD 6m. The interest

rate on the new debt will be 12% per annum. Operating profit is expected to

stay constant after the new finance has been raised.

What will be the interest cover and the capital gearing ratio (measured as

debt/(debt + equity) at book value, and including the bank overdraft as

part of debt) for X Co after the new finance has been raised?

A Interest cover 2.33, gearing 52.8%

B Interest cover 2.33, gearing 56.9%

C Interest cover 1.22, gearing 52.8%

D Interest cover 1.22, gearing 56.9%

Solution

The answer is (A).

Interest cover = 4m/(1m + (12% × 6m)) = 2.33 times

Capital gearing ratio

Debt = 5m + 8m + 6m = USD19m

Equity = 10m + 4m + 1.5m + 1.5m = USD17m

D/(D+E) = 19m/(19m + 17m) × 100 = 52.8%

169