Page 181 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 181

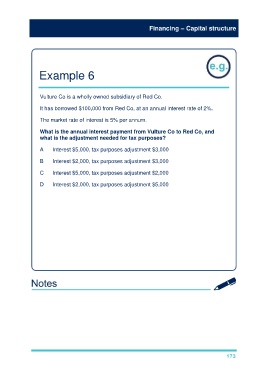

Financing – Capital structure

Example 6

Vulture Co is a wholly owned subsidiary of Red Co.

It has borrowed $100,000 from Red Co, at an annual interest rate of 2%.

The market rate of interest is 5% per annum.

What is the annual interest payment from Vulture Co to Red Co, and

what is the adjustment needed for tax purposes?

A Interest $5,000, tax purposes adjustment $3,000

B Interest $2,000, tax purposes adjustment $3,000

C Interest $5,000, tax purposes adjustment $2,000

D Interest $2,000, tax purposes adjustment $5,000

Solution

The answer is (B).

Annual interest payment = $100,000 × 2% = $2,000

However, at market rate of interest (5%) the interest paid would have been

$100,000 × 5% = $5,000.

Therefore an adjustment of $3,000 (5,000 – 2,000) will be made to Vulture Co

and Red Co's accounts for tax purposes. Vulture Co will reduce its profits for

tax purposes and Red Co will increase its profits by the same amount.

173