Page 200 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 200

Chapter 8

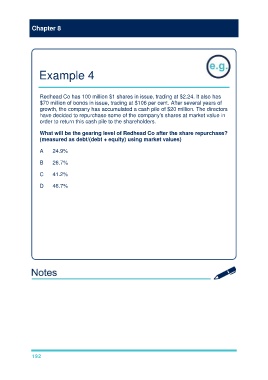

Example 4

Redhead Co has 100 million $1 shares in issue, trading at $2.24. It also has

$70 million of bonds in issue, trading at $106 per cent. After several years of

growth, the company has accumulated a cash pile of $20 million. The directors

have decided to repurchase some of the company's shares at market value in

order to return this cash pile to the shareholders.

What will be the gearing level of Redhead Co after the share repurchase?

(measured as debt/(debt + equity) using market values)

A 24.9%

B 26.7%

C 41.2%

D 46.7%

Solution

The answer is (B).

Market value of debt is $70m × 1.06 = $74.2m

Current market value of equity is 100m × $2.24 = $224m, so after the share

repurchase it will be $204m.

Therefore (D/(D+E)) = 74.2/(74.2 + 204) = 26.7%

192