Page 208 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 208

Chapter 9

Synergy

2.1 Definition of synergy

Synergy may be defined as two or more entities coming together to

produce a result not independently obtainable.

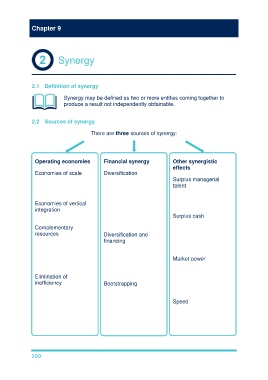

2.2 Sources of synergy

There are three sources of synergy:

Operating economies Financial synergy Other synergistic

effects

Economies of scale – Diversification – reduces

can occur in the risk, so even if the Surplus managerial

production, marketing or earnings stay the same talent – the acquisition of

finance areas. (i.e. no operating inefficient companies is

economies are a good way to utilise

Economies of vertical obtained), there could skilled managers.

integration – 'cutting out still be an increase in

the middle man'. value of the company Surplus cash –

due to the lower risk. acquisition uses surplus

Complementary cash if increased

resources – e.g. Diversification and dividends are not

combining an R&D financing – the variability considered to be

company with a of operating cash flows appropriate.

company strong in may be reduced, which

marketing could lead to is more attractive to Market power –

gains. creditors so could lead horizontal combinations

to cheaper financing. may give monopoly

Elimination of power that can increase

inefficiency – If the victim Bootstrapping – profitability (but beware

company is badly companies with high P/E competition authorities).

managed. ratios are in a good

position to acquire other Speed – acquisition is

companies as they can usually much faster than

impose their high P/E organic growth.

ratio on the victim firm

and increase its value.

200