Page 217 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 217

Financial and strategic implications of mergers and acquisitions

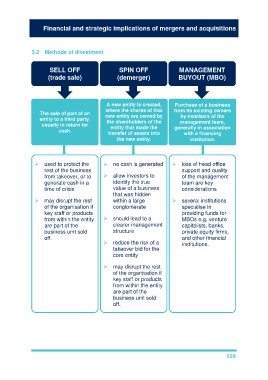

5.2 Methods of divestment

SELL OFF SPIN OFF MANAGEMENT

(trade sale) (demerger) BUYOUT (MBO)

A new entity is created, Purchase of a business

where the shares of that from its existing owners

The sale of part of an new entity are owned by by members of the

entity to a third party, the shareholders of the management team,

usually in return for

cash. entity that made the generally in association

transfer of assets into with a financing

the new entity.

institution.

used to protect the no cash is generated loss of head office

rest of the business support and quality

from takeover, or to allow investors to of the management

generate cash in a identify the true team are key

time of crisis value of a business considerations

that was hidden

may disrupt the rest within a large several institutions

of the organisation if conglomerate specialise in

key staff or products providing funds for

from within the entity should lead to a MBOs e.g. venture

are part of the clearer management capitalists, banks,

business unit sold structure private equity firms,

off. and other financial

reduce the risk of a institutions.

takeover bid for the

core entity

may disrupt the rest

of the organisation if

key staff or products

from within the entity

are part of the

business unit sold

off.

209