Page 221 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 221

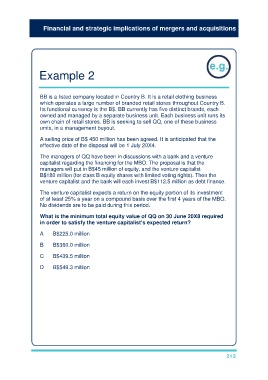

Financial and strategic implications of mergers and acquisitions

Example 2

BB is a listed company located in Country B. It is a retail clothing business

which operates a large number of branded retail stores throughout Country B.

Its functional currency is the B$. BB currently has five distinct brands, each

owned and managed by a separate business unit. Each business unit runs its

own chain of retail stores. BB is seeking to sell QQ, one of these business

units, in a management buyout.

A selling price of B$ 450 million has been agreed. It is anticipated that the

effective date of the disposal will be 1 July 20X4.

The managers of QQ have been in discussions with a bank and a venture

capitalist regarding the financing for the MBO. The proposal is that the

managers will put in B$45 million of equity, and the venture capitalist

B$180 million (for class B equity shares with limited voting rights). Then the

venture capitalist and the bank will each invest B$112.5 million as debt finance.

The venture capitalist expects a return on the equity portion of its investment

of at least 25% a year on a compound basis over the first 4 years of the MBO.

No dividends are to be paid during this period.

What is the minimum total equity value of QQ on 30 June 20X8 required

in order to satisfy the venture capitalist’s expected return?

A B$225.0 million

B B$360.0 million

C B$439.5 million

D B$549.3 million

Solution

The answer is (D).

The VC is making a B$ 180 million equity investment. To generate a return of

25% a year on a compound basis this investment will need to grow to

4

B$ 439.5 million (= B$ 180 million × (1.25) ) at the end of 4 years.

The VC investment represents 80% (= 180/(180 + 45) × 100%) of the equity,

therefore the total equity value will need to be B$ 549.3 million (= B$ 439.5

million/0.80).

213