Page 223 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 223

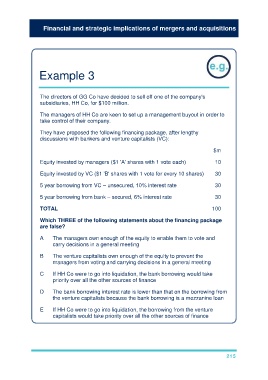

Financial and strategic implications of mergers and acquisitions

Example 3

The directors of GG Co have decided to sell off one of the company's

subsidiaries, HH Co, for $100 million.

The managers of HH Co are keen to set up a management buyout in order to

take control of their company.

They have proposed the following financing package, after lengthy

discussions with bankers and venture capitalists (VC):

$m

Equity invested by managers ($1 'A' shares with 1 vote each) 10

Equity invested by VC ($1 'B' shares with 1 vote for every 10 shares) 30

5 year borrowing from VC – unsecured, 10% interest rate 30

5 year borrowing from bank – secured, 6% interest rate 30

TOTAL 100

Which THREE of the following statements about the financing package

are false?

A The managers own enough of the equity to enable them to vote and

carry decisions in a general meeting

B The venture capitalists own enough of the equity to prevent the

managers from voting and carrying decisions in a general meeting

C If HH Co were to go into liquidation, the bank borrowing would take

priority over all the other sources of finance

D The bank borrowing interest rate is lower than that on the borrowing from

the venture capitalists because the bank borrowing is a mezzanine loan

E If HH Co were to go into liquidation, the borrowing from the venture

capitalists would take priority over all the other sources of finance

215