Page 251 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 251

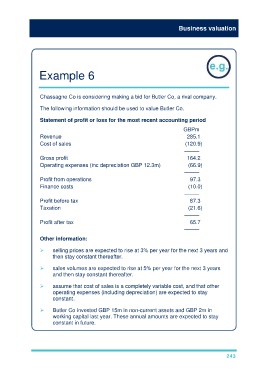

Business valuation

Example 6

Chassagne Co is considering making a bid for Butler Co, a rival company.

The following information should be used to value Butler Co.

Statement of profit or loss for the most recent accounting period

GBPm

Revenue 285.1

Cost of sales (120.9)

–––––

Gross profit 164.2

Operating expenses (inc depreciation GBP 12.3m) (66.9)

–––––

Profit from operations 97.3

Finance costs (10.0)

–––––

Profit before tax 87.3

Taxation (21.6)

–––––

Profit after tax 65.7

–––––

Other information:

selling prices are expected to rise at 3% per year for the next 3 years and

then stay constant thereafter.

sales volumes are expected to rise at 5% per year for the next 3 years

and then stay constant thereafter.

assume that cost of sales is a completely variable cost, and that other

operating expenses (including depreciation) are expected to stay

constant.

Butler Co invested GBP 15m in non-current assets and GBP 2m in

working capital last year. These annual amounts are expected to stay

constant in future.

243