Page 270 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 270

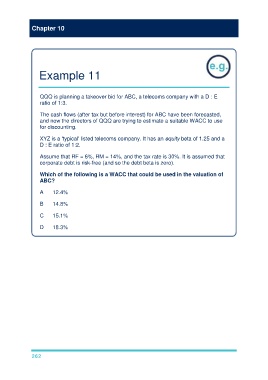

Chapter 10

Example 11

QQQ is planning a takeover bid for ABC, a telecoms company with a D : E

ratio of 1:3.

The cash flows (after tax but before interest) for ABC have been forecasted,

and now the directors of QQQ are trying to estimate a suitable WACC to use

for discounting.

XYZ is a 'typical' listed telecoms company. It has an equity beta of 1.25 and a

D : E ratio of 1:2.

Assume that RF = 6%, RM = 14%, and the tax rate is 30%. It is assumed that

corporate debt is risk-free (and so the debt beta is zero).

Which of the following is a WACC that could be used in the valuation of

ABC?

A 12.4%

B 14.8%

C 15.1%

D 18.3%

262