Page 330 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 330

Chapter 12

Chapter 5

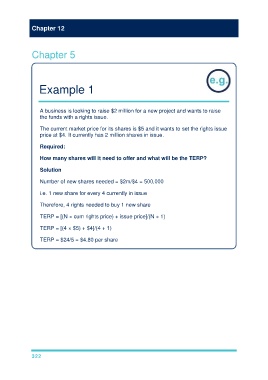

Example 1

A business is looking to raise $2 million for a new project and wants to raise

the funds with a rights issue.

The current market price for its shares is $5 and it wants to set the rights issue

price at $4. It currently has 2 million shares in issue.

Required:

How many shares will it need to offer and what will be the TERP?

Solution

Number of new shares needed = $2m/$4 = 500,000

i.e. 1 new share for every 4 currently in issue

Therefore, 4 rights needed to buy 1 new share

TERP = [(N × cum rights price) + issue price]/(N + 1)

TERP = [(4 × $5) + $4]/(4 + 1)

TERP = $24/5 = $4.80 per share

322