Page 335 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 335

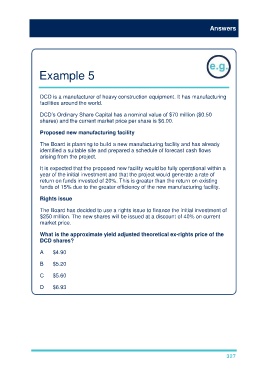

Answers

Example 5

DCD is a manufacturer of heavy construction equipment. It has manufacturing

facilities around the world.

DCD’s Ordinary Share Capital has a nominal value of $70 million ($0.50

shares) and the current market price per share is $6.00.

Proposed new manufacturing facility

The Board is planning to build a new manufacturing facility and has already

identified a suitable site and prepared a schedule of forecast cash flows

arising from the project.

It is expected that the proposed new facility would be fully operational within a

year of the initial investment and that the project would generate a rate of

return on funds invested of 20%. This is greater than the return on existing

funds of 15% due to the greater efficiency of the new manufacturing facility.

Rights issue

The Board has decided to use a rights issue to finance the initial investment of

$250 million. The new shares will be issued at a discount of 40% on current

market price.

What is the approximate yield adjusted theoretical ex-rights price of the

DCD shares?

A $4.90

B $5.20

C $5.60

D $6.93

327