Page 336 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 336

Chapter 12

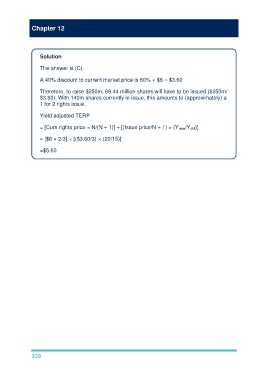

Solution

The answer is (C).

A 40% discount to current market price is 60% × $6 = $3.60

Therefore, to raise $250m, 69.44 million shares will have to be issued ($250m/

$3.60). With 140m shares currently in issue, this amounts to (approximately) a

1 for 2 rights issue.

Yield adjusted TERP

= [Cum rights price × N/(N + 1)] + [(Issue price/N + 1) × (Y new/Y old)]

= [$6 × 2/3] + [($3.60/3) × (20/15)]

=$5.60

328