Page 340 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 340

Chapter 12

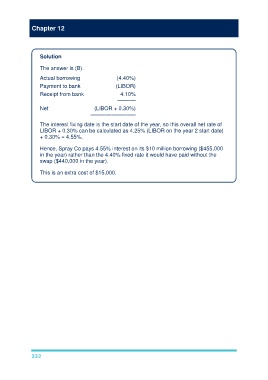

Solution

The answer is (B).

Actual borrowing (4.40%)

Payment to bank (LIBOR)

Receipt from bank 4.10%

––––––

Net (LIBOR + 0.30%)

–––––––––––––––

The interest fixing date is the start date of the year, so this overall net rate of

LIBOR + 0.30% can be calculated as 4.25% (LIBOR on the year 2 start date)

+ 0.30% = 4.55%.

Hence, Spray Co pays 4.55% interest on its $10 million borrowing ($455,000

in the year) rather than the 4.40% fixed rate it would have paid without the

swap ($440,000 in the year).

This is an extra cost of $15,000.

332