Page 345 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 345

Answers

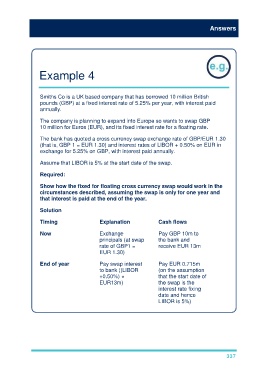

Example 4

Smiths Co is a UK based company that has borrowed 10 million British

pounds (GBP) at a fixed interest rate of 5.25% per year, with interest paid

annually.

The company is planning to expand into Europe so wants to swap GBP

10 million for Euros (EUR), and its fixed interest rate for a floating rate.

The bank has quoted a cross currency swap exchange rate of GBP/EUR 1.30

(that is, GBP 1 = EUR 1.30) and interest rates of LIBOR + 0.50% on EUR in

exchange for 5.25% on GBP, with interest paid annually.

Assume that LIBOR is 5% at the start date of the swap.

Required:

Show how the fixed for floating cross currency swap would work in the

circumstances described, assuming the swap is only for one year and

that interest is paid at the end of the year.

Solution

Timing Explanation Cash flows

Now Exchange Pay GBP 10m to

principals (at swap the bank and

rate of GBP1 = receive EUR 13m

EUR 1.30)

End of year Pay swap interest Pay EUR 0.715m

to bank ((LIBOR (on the assumption

+0.50%) × that the start date of

EUR13m) the swap is the

interest rate fixing

date and hence

LIBOR is 5%)

337