Page 347 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 347

Answers

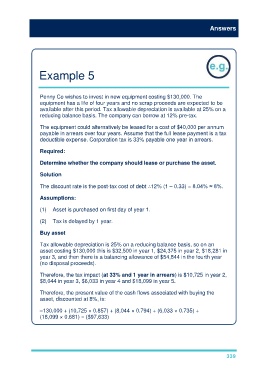

Example 5

Penny Co wishes to invest in new equipment costing $130,000. The

equipment has a life of four years and no scrap proceeds are expected to be

available after this period. Tax allowable depreciation is available at 25% on a

reducing balance basis. The company can borrow at 12% pre-tax.

The equipment could alternatively be leased for a cost of $40,000 per annum

payable in arrears over four years. Assume that the full lease payment is a tax

deductible expense. Corporation tax is 33% payable one year in arrears.

Required:

Determine whether the company should lease or purchase the asset.

Solution

The discount rate is the post-tax cost of debt ∴12% (1 – 0.33) = 8.04% ≈ 8%.

Assumptions:

(1) Asset is purchased on first day of year 1.

(2) Tax is delayed by 1 year.

Buy asset

Tax allowable depreciation is 25% on a reducing balance basis, so on an

asset costing $130,000 this is $32,500 in year 1, $24,375 in year 2, $18,281 in

year 3, and then there is a balancing allowance of $54,844 in the fourth year

(no disposal proceeds).

Therefore, the tax impact (at 33% and 1 year in arrears) is $10,725 in year 2,

$8,044 in year 3, $6,033 in year 4 and $18,099 in year 5.

Therefore, the present value of the cash flows associated with buying the

asset, discounted at 8%, is:

–130,000 + (10,725 × 0.857) + (8,044 × 0.794) + (6,033 × 0.735) +

(18,099 × 0.681) = ($97,633)

339