Page 88 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 88

Chapter 4

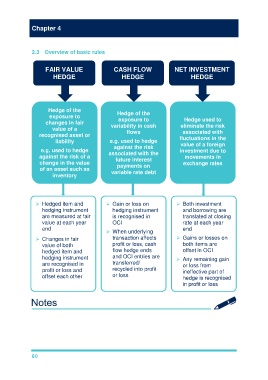

2.3 Overview of basic rules

FAIR VALUE CASH FLOW NET INVESTMENT

HEDGE HEDGE HEDGE

Hedge of the Hedge of the

exposure to

changes in fair exposure to Hedge used to

value of a variability in cash eliminate the risk

recognised asset or flows associated with

liability e.g. used to hedge fluctuations in the

against the risk value of a foreign

e.g. used to hedge associated with the investment due to

against the risk of a future interest movements in

change in the value exchange rates

of an asset such as payments on

inventory variable rate debt

Hedged item and Gain or loss on Both investment

hedging instrument hedging instrument and borrowing are

are measured at fair is recognised in translated at closing

value at each year OCI rate at each year

end end

When underlying

Changes in fair transaction affects Gains or losses on

value of both profit or loss, cash both items are

hedged item and flow hedge ends offset in OCI

hedging instrument and OCI entries are Any remaining gain

are recognised in transferred/ or loss from

profit or loss and recycled into profit ineffective part of

offset each other or loss hedge is recognised

in profit or loss

80