Page 91 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 91

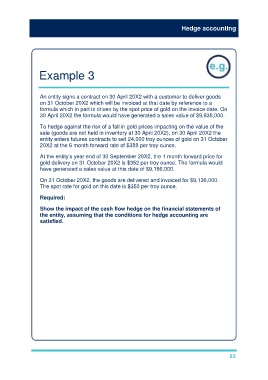

Hedge accounting

Example 3

An entity signs a contract on 30 April 20X2 with a customer to deliver goods

on 31 October 20X2 which will be invoiced at that date by reference to a

formula which in part is driven by the spot price of gold on the invoice date. On

30 April 20X2 the formula would have generated a sales value of $9,938,000.

To hedge against the risk of a fall in gold prices impacting on the value of the

sale (goods are not held in inventory at 30 April 20X2), on 30 April 20X2 the

entity enters futures contracts to sell 24,000 troy ounces of gold on 31 October

20X2 at the 6 month forward rate of $388 per troy ounce.

At the entity’s year end of 30 September 20X2, the 1 month forward price for

gold delivery on 31 October 20X2 is $352 per troy ounce. The formula would

have generated a sales value at this date of $9,186,000.

On 31 October 20X2, the goods are delivered and invoiced for $9,136,000.

The spot rate for gold on this date is $350 per troy ounce.

Required:

Show the impact of the cash flow hedge on the financial statements of

the entity, assuming that the conditions for hedge accounting are

satisfied.

Solution

The entity is hedging the volatility of the future cash inflow from selling the gold

goods. The futures contracts can be accounted for as a cash flow hedge in

respect of those inflows, providing the criteria for hedge accounting are met.

During the financial year ending 30 September 20X2

The gain on the futures contracts before the entity’s year end is calculated as:

$

Forward value of contract at 30 April 20X2

(24,000 × $388) = 9,312,000

Forward value of contract at 30 September 20X2

(24,000 × $352) = 8,448,000

–––––––––

Gain on contract 864,000

83