Page 99 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 99

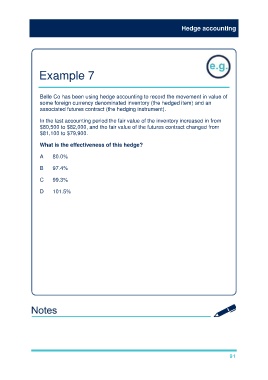

Hedge accounting

Example 7

Belle Co has been using hedge accounting to record the movement in value of

some foreign currency denominated inventory (the hedged item) and an

associated futures contract (the hedging instrument).

In the last accounting period the fair value of the inventory increased in from

$80,500 to $82,000, and the fair value of the futures contract changed from

$81,100 to $79,900.

What is the effectiveness of this hedge?

A 80.0%

B 97.4%

C 99.3%

D 101.5%

Solution

The answer is (A).

The effectiveness of the hedge is calculated by comparing the movement in

the value of the hedged item and the movement in the value of the hedging

instrument.

i.e. a movement of ($82,000 – $80,500 =) $1,500 in the fair value of the

hedged item and a movement of ($81,100 – $79,900 =) $1,200 in the fair

value of the hedging instrument.

Therefore effectiveness is 1,200/1,500 = 80.0%

(or alternatively 1,500/1,200 = 125%).

91