Page 243 - Microsoft Word - 00 P1 IW Prelims.docx

P. 243

Complex groups

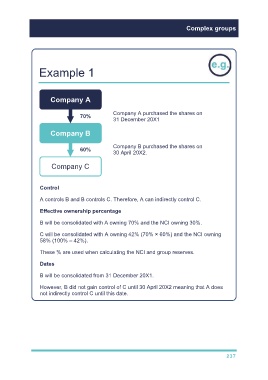

Example 1

Company A

70% Company A purchased the shares on

31 December 20X1

Company B

Company B purchased the shares on

60% 30 April 20X2.

Company C

Control

A controls B and B controls C. Therefore, A can indirectly control C.

Effective ownership percentage

B will be consolidated with A owning 70% and the NCI owning 30%.

C will be consolidated with A owning 42% (70% × 60%) and the NCI owning

58% (100% – 42%).

These % are used when calculating the NCI and group reserves.

Dates

B will be consolidated from 31 December 20X1.

However, B did not gain control of C until 30 April 20X2 meaning that A does

not indirectly control C until this date.

237