Page 3 - PowerPoint Presentation

P. 3

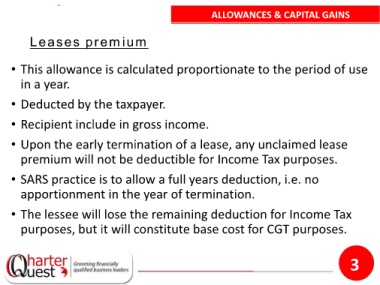

ALLOWANCES & CAPITAL GAINS

Leases premium

• This allowance is calculated proportionate to the period of use

in a year.

• Deducted by the taxpayer.

• Recipient include in gross income.

• Upon the early termination of a lease, any unclaimed lease

premium will not be deductible for Income Tax purposes.

• SARS practice is to allow a full years deduction, i.e. no

apportionment in the year of termination.

• The lessee will lose the remaining deduction for Income Tax

purposes, but it will constitute base cost for CGT purposes.

3