Page 8 - PowerPoint Presentation

P. 8

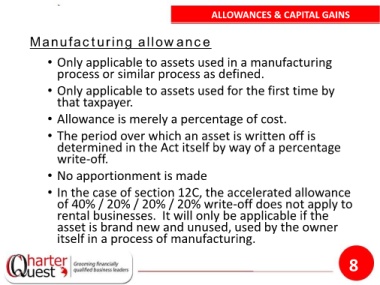

ALLOWANCES & CAPITAL GAINS

Manufacturing allowance

• Only applicable to assets used in a manufacturing

process or similar process as defined.

• Only applicable to assets used for the first time by

that taxpayer.

• Allowance is merely a percentage of cost.

• The period over which an asset is written off is

determined in the Act itself by way of a percentage

write-off.

• No apportionment is made

• In the case of section 12C, the accelerated allowance

of 40% / 20% / 20% / 20% write-off does not apply to

rental businesses. It will only be applicable if the

asset is brand new and unused, used by the owner

itself in a process of manufacturing.

8