Page 12 - PowerPoint Presentation

P. 12

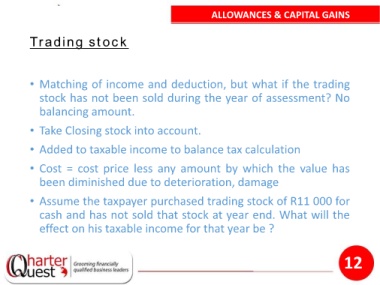

ALLOWANCES & CAPITAL GAINS

Trading stock

• Matching of income and deduction, but what if the trading

stock has not been sold during the year of assessment? No

balancing amount.

• Take Closing stock into account.

• Added to taxable income to balance tax calculation

• Cost = cost price less any amount by which the value has

been diminished due to deterioration, damage

• Assume the taxpayer purchased trading stock of R11 000 for

cash and has not sold that stock at year end. What will the

effect on his taxable income for that year be ?

12