Page 9 - PowerPoint Presentation

P. 9

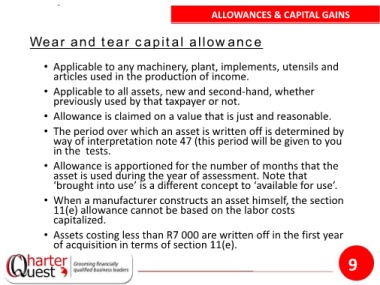

ALLOWANCES & CAPITAL GAINS

Wear and tear capital allowance

• Applicable to any machinery, plant, implements, utensils and

articles used in the production of income.

• Applicable to all assets, new and second-hand, whether

previously used by that taxpayer or not.

• Allowance is claimed on a value that is just and reasonable.

• The period over which an asset is written off is determined by

way of interpretation note 47 (this period will be given to you

in the tests.

• Allowance is apportioned for the number of months that the

asset is used during the year of assessment. Note that

‘brought into use’ is a different concept to ‘available for use’.

• When a manufacturer constructs an asset himself, the section

11(e) allowance cannot be based on the labor costs

capitalized.

• Assets costing less than R7 000 are written off in the first year

of acquisition in terms of section 11(e).

9