Page 25 - AMANGO MODEL ANSWER 1

P. 25

P a g e | 25

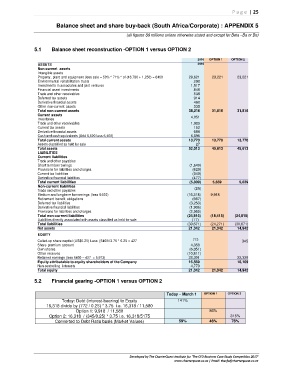

Balance sheet and share buy-back (South Africa/Corporate) : APPENDIX 5

(all figures S$ millions unless otherwise stated and except for Beta –Ba or Be)

5.1 Balance sheet reconstruction -OPTION 1 versus OPTION 2

2016 OPTION 1 OPTION 2

ASSETS 2016

Non-current assets

Intangible assets

Property, plant and equipment (less sale = 50% * 71% * of (16,780 + 1,250) = 6400 29,621 23,221 23,221

3,394

Environmental rehabilitation trusts 290 3,912

Investments in associates and joint ventures 1,817

Financial asset investments 846

Trade and other receivables 539

Deferred tax assets 914

Derivative financial assets 460

Other non-current assets 335

Total non-current assets 38,216 31,816 31,816

Current assets

Inventories 4,051

Trade and other receivables 1,983

Current tax assets 152

Derivative financial assets 689

Cash and cash equivalents (Add 6,500 less 6,400) 6,895

Total current assets 13,770 13,770 13,770

Assets classified as held for sale 27

Total assets 52,013 45,613 45,613

LIABILITIES

Current liabilities

Trade and other payables

Short term borrowings (1,649)

(620)

Provisions for liabilities and charges (2,753)

Current tax liabilities (340)

Derivative financial liabilities (477)

Total current liabilities (5,839) 5,839 5,839

Non-current liabilities (26)

Trade and other payables

Medium and long term borrowings (less 6400) (16,318) 9,918

Retirement benefit obligations (667)

Deferred tax liabilities (3,253)

Derivative financial liabilities (1,986)

Provisions for liabilities and charges (2,565)

Total non-current liabilities (24,815) (18,415) (24,815)

Liabilities directly associated with assets classified as held for sale (17)

Total liabilities (30,671) (24,271) (30,671)

Net assets 21,342 21,342 14,942

EQUITY 1,342

Called-up share capital (US$0.25) Less [6400//3.75 * 0.25 = 427 772 345

Share premium account 4,358

772

Own shares (6,051)

Other reserves (10,811)

Retained earnings (less 6400 – 427 = 5,973) 28,301 22,328

Equity attributable to equity shareholders of the Company 16,569 22,328

10,169

Non-controlling interests 4,773 6 2

Total equity 21,342 21,342 14,942

5

5.2 Financial gearing -OPTION 1 versus OPTION 2

Today – March 1 OPTION 1 OPTION 2

Today: Debt (interest-bearing) to Equity 141%

16,318 divide by (772 / 0.25) * 3.75 i.e. 16,318 / 11,580

Option 1: 9,918 / 11,580 86%

Option 2: 16,318 / (345/0.25) * 3.75 i.e. 16,318/5175 315%

Converted to Debt Ratio basis (Market Values) 59% 46% 76%

Developed by The CharterQuest Institute for 'The CFO Business Case Study Competition 2017'

www.charterquest.co.za | Email: thecfo@charterquest.co.za