Page 29 - AMANGO MODEL ANSWER 1

P. 29

P a g e | 29

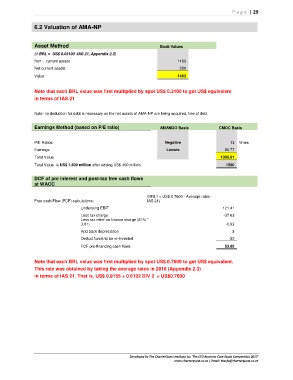

6.2 Valuation of AMA-NP

Asset Method Book Values

(1 BRL = US$ 0.03100 -IAS 21, Appendix 2.3)

Non - current assets 1153

Net current assets 250

Value 1403

Note that each BRL value was first multiplied by spot US$ 0.3100 to get US$ equivalent

in terms of IAS 21

Note: no deduction for debt is necessary as the net assets of AMA-NP are being acquired, free of debt.

Earnings Method (based on P/E ratio) AMANGO Basis CMOC Basis

P/E Ratios Negative 13 times

Earnings Losses 80.77

Total Value 1050.01

Total Value is US$ 1,500 million after adding US$ 450 million. 1500

DCF of pre interest and post-tax free cash flows

at WACC

(BRL1 = US$ 0.7600 - Average rates -

Free cash Flow (FCF) calculations: IAS 21)

Underlying EBIT 121.41

Less tax charge -37.63

Less tax relief on finance charge (31% *

3.01) -0.93

Add back depreciation 3

Deduct funds to be re-invested -32

FCF pre-financing cash flows 53.85

Note that each BRL value was first multiplied by spot US$ 0.7600 to get US$ equivalent.

This rate was obtained by taking the average rates in 2016 (Appendix 2.3)

in terms of IAS 21. That is, US$ 0.9155 + 0.6122 DIV 2 = US$0.7600

Developed by The CharterQuest Institute for 'The CFO Business Case Study Competition 2017'

www.charterquest.co.za | Email: thecfo@charterquest.co.za