Page 10 - FINAL CFA II SLIDES JUNE 2019 DAY 2

P. 10

LOS 7.d: Distinguish between the dependent and

independent variables in a linear regression. MODULE 7.2: LINEAR REGRESSION: INTRODUCTION

Dependent variable (also called the explained, endogenous, or the predicted variable) is the one (e.g. Y) whose variation is

explained by the independent variable (e.g. X) in the form: Y = a + bX

Independent variable (also called the explanatory variable, exogenous, or predicting variable) is used to explain the variation

of the dependent variable.

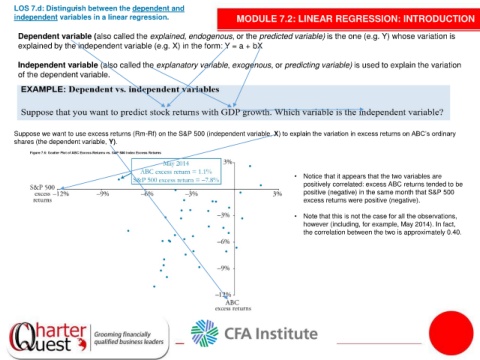

Suppose we want to use excess returns (Rm-Rf) on the S&P 500 (independent variable, X) to explain the variation in excess returns on ABC’s ordinary

shares (the dependent variable, Y).

• Notice that it appears that the two variables are

positively correlated: excess ABC returns tended to be

positive (negative) in the same month that S&P 500

excess returns were positive (negative).

• Note that this is not the case for all the observations,

however (including, for example, May 2014). In fact,

the correlation between the two is approximately 0.40.