Page 172 - Microsoft Word - 00 Prelims.docx

P. 172

Chapter 7

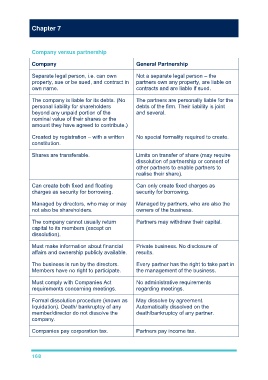

Company versus partnership

Company General Partnership

Separate legal person, i.e. can own Not a separate legal person – the

property, sue or be sued, and contract in partners own any property, are liable on

own name. contracts and are liable if sued.

The company is liable for its debts. (No The partners are personally liable for the

personal liability for shareholders debts of the firm. Their liability is joint

beyond any unpaid portion of the and several.

nominal value of their shares or the

amount they have agreed to contribute.)

Created by registration – with a written No special formality required to create.

constitution.

Shares are transferable. Limits on transfer of share (may require

dissolution of partnership or consent of

other partners to enable partners to

realise their share).

Can create both fixed and floating Can only create fixed charges as

charges as security for borrowing. security for borrowing.

Managed by directors, who may or may Managed by partners, who are also the

not also be shareholders. owners of the business.

The company cannot usually return Partners may withdraw their capital.

capital to its members (except on

dissolution).

Must make information about financial Private business. No disclosure of

affairs and ownership publicly available. results.

The business is run by the directors. Every partner has the right to take part in

Members have no right to participate. the management of the business.

Must comply with Companies Act No administrative requirements

requirements concerning meetings. regarding meetings.

Formal dissolution procedure (known as May dissolve by agreement.

liquidation). Death/ bankruptcy of any Automatically dissolved on the

member/director do not dissolve the death/bankruptcy of any partner.

company.

Companies pay corporation tax. Partners pay income tax.

168