Page 190 - Microsoft Word - 00 Prelims.docx

P. 190

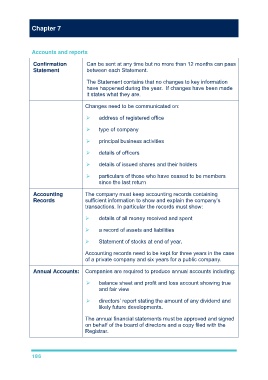

Chapter 7

Accounts and reports

Confirmation Can be sent at any time but no more than 12 months can pass

Statement between each Statement.

The Statement contains that no changes to key information

have happened during the year. If changes have been made

it states what they are.

Changes need to be communicated on:

address of registered office

type of company

principal business activities

details of officers

details of issued shares and their holders

particulars of those who have ceased to be members

since the last return

Accounting The company must keep accounting records containing

Records sufficient information to show and explain the company’s

transactions. In particular the records must show:

details of all money received and spent

a record of assets and liabilities

Statement of stocks at end of year.

Accounting records need to be kept for three years in the case

of a private company and six years for a public company.

Annual Accounts: Companies are required to produce annual accounts including:

balance sheet and profit and loss account showing true

and fair view

directors’ report stating the amount of any dividend and

likely future developments.

The annual financial statements must be approved and signed

on behalf of the board of directors and a copy filed with the

Registrar.

186