Page 209 - Microsoft Word - 00 Prelims.docx

P. 209

Capital and financing

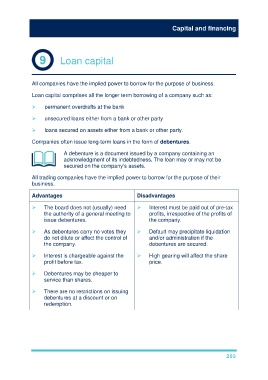

Loan capital

All companies have the implied power to borrow for the purpose of business.

Loan capital comprises all the longer term borrowing of a company such as:

permanent overdrafts at the bank

unsecured loans either from a bank or other party

loans secured on assets either from a bank or other party.

Companies often issue long-term loans in the form of debentures.

A debenture is a document issued by a company containing an

acknowledgment of its indebtedness. The loan may or may not be

secured on the company’s assets.

All trading companies have the implied power to borrow for the purpose of their

business.

Advantages Disadvantages

The board does not (usually) need Interest must be paid out of pre-tax

the authority of a general meeting to profits, irrespective of the profits of

issue debentures. the company.

As debentures carry no votes they Default may precipitate liquidation

do not dilute or affect the control of and/or administration if the

the company. debentures are secured.

Interest is chargeable against the High gearing will affect the share

profit before tax. price.

Debentures may be cheaper to

service than shares.

There are no restrictions on issuing

debentures at a discount or on

redemption.

205