Page 23 - PowerPoint Presentation

P. 23

LEASES LEASES

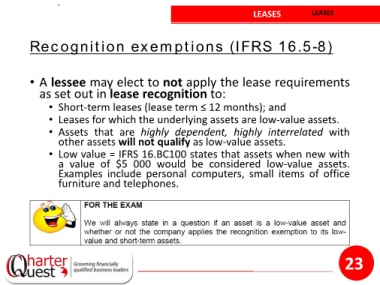

Recognition exemptions (IFRS 16.5-8)

• A lessee may elect to not apply the lease requirements

as set out in lease recognition to:

• Short-term leases (lease term ≤ 12 months); and

• Leases for which the underlying assets are low-value assets.

• Assets that are highly dependent, highly interrelated with

other assets will not qualify as low-value assets.

• Low value = IFRS 16.BC100 states that assets when new with

a value of $5 000 would be considered low-value assets.

Examples include personal computers, small items of office

furniture and telephones.

23