Page 25 - PowerPoint Presentation

P. 25

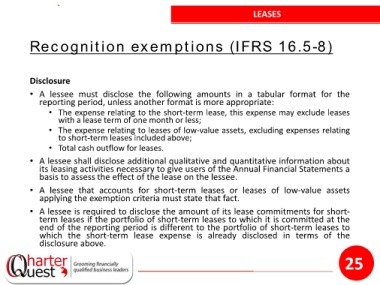

LEASES

Recognition exemptions (IFRS 16.5-8)

Disclosure

• A lessee must disclose the following amounts in a tabular format for the

reporting period, unless another format is more appropriate:

• The expense relating to the short-term lease, this expense may exclude leases

with a lease term of one month or less;

• The expense relating to leases of low-value assets, excluding expenses relating

to short-term leases included above;

• Total cash outflow for leases.

• A lessee shall disclose additional qualitative and quantitative information about

its leasing activities necessary to give users of the Annual Financial Statements a

basis to assess the effect of the lease on the lessee.

• A lessee that accounts for short-term leases or leases of low-value assets

applying the exemption criteria must state that fact.

• A lessee is required to disclose the amount of its lease commitments for short-

term leases if the portfolio of short-term leases to which it is committed at the

end of the reporting period is different to the portfolio of short-term leases to

which the short-term lease expense is already disclosed in terms of the

disclosure above.

25