Page 11 - P6 Slide Taxation - Lecture Day 6 - Provisional Tax Companies Only

P. 11

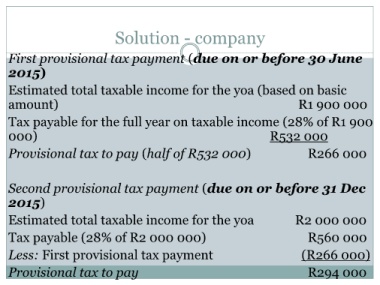

Solution - company

First provisional tax payment (due on or before 30 June

2015)

Estimated total taxable income for the yoa (based on basic

amount) R1 900 000

Tax payable for the full year on taxable income (28% of R1 900

000) R532 000

Provisional tax to pay (half of R532 000) R266 000

Second provisional tax payment (due on or before 31 Dec

2015)

Estimated total taxable income for the yoa R2 000 000

Tax payable (28% of R2 000 000) R560 000

Less: First provisional tax payment (R266 000)

Provisional tax to pay R294 000