Page 16 - P6 Slide Taxation - Lecture Day 6 - Provisional Tax Companies Only

P. 16

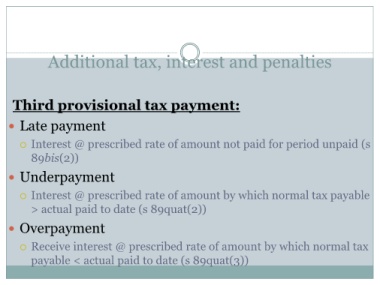

Additional tax, interest and penalties

Third provisional tax payment:

Late payment

Interest @ prescribed rate of amount not paid for period unpaid (s

89bis(2))

Underpayment

Interest @ prescribed rate of amount by which normal tax payable

> actual paid to date (s 89quat(2))

Overpayment

Receive interest @ prescribed rate of amount by which normal tax

payable < actual paid to date (s 89quat(3))