Page 32 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 32

READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

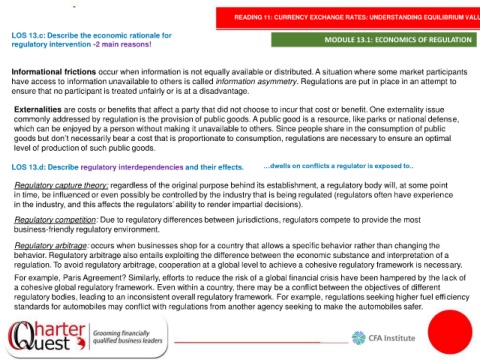

LOS 13.c: Describe the economic rationale for MODULE 13.1: ECONOMICS OF REGULATION

regulatory intervention -2 main reasons!

Informational frictions occur when information is not equally available or distributed. A situation where some market participants

have access to information unavailable to others is called information asymmetry. Regulations are put in place in an attempt to

ensure that no participant is treated unfairly or is at a disadvantage.

Externalities are costs or benefits that affect a party that did not choose to incur that cost or benefit. One externality issue

commonly addressed by regulation is the provision of public goods. A public good is a resource, like parks or national defense,

which can be enjoyed by a person without making it unavailable to others. Since people share in the consumption of public

goods but don’t necessarily bear a cost that is proportionate to consumption, regulations are necessary to ensure an optimal

level of production of such public goods.

LOS 13.d: Describe regulatory interdependencies and their effects. …dwells on conflicts a regulator is exposed to..

Regulatory capture theory: regardless of the original purpose behind its establishment, a regulatory body will, at some point

in time, be influenced or even possibly be controlled by the industry that is being regulated (regulators often have experience

in the industry, and this affects the regulators’ ability to render impartial decisions).

Regulatory competition: Due to regulatory differences between jurisdictions, regulators compete to provide the most

business-friendly regulatory environment.

Regulatory arbitrage: occurs when businesses shop for a country that allows a specific behavior rather than changing the

behavior. Regulatory arbitrage also entails exploiting the difference between the economic substance and interpretation of a

regulation. To avoid regulatory arbitrage, cooperation at a global level to achieve a cohesive regulatory framework is necessary.

For example, Paris Agreement? Similarly, efforts to reduce the risk of a global financial crisis have been hampered by the lack of

a cohesive global regulatory framework. Even within a country, there may be a conflict between the objectives of different

regulatory bodies, leading to an inconsistent overall regulatory framework. For example, regulations seeking higher fuel efficiency

standards for automobiles may conflict with regulations from another agency seeking to make the automobiles safer.