Page 33 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 33

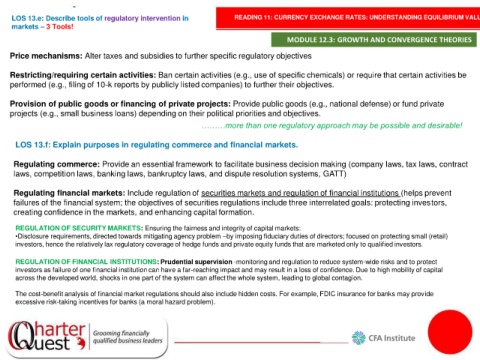

LOS 13.e: Describe tools of regulatory intervention in READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

markets – 3 Tools!

MODULE 12.3: GROWTH AND CONVERGENCE THEORIES

Price mechanisms: Alter taxes and subsidies to further specific regulatory objectives

Restricting/requiring certain activities: Ban certain activities (e.g., use of specific chemicals) or require that certain activities be

performed (e.g., filing of 10-k reports by publicly listed companies) to further their objectives.

Provision of public goods or financing of private projects: Provide public goods (e.g., national defense) or fund private

projects (e.g., small business loans) depending on their political priorities and objectives.

………more than one regulatory approach may be possible and desirable!

LOS 13.f: Explain purposes in regulating commerce and financial markets.

Regulating commerce: Provide an essential framework to facilitate business decision making (company laws, tax laws, contract

laws, competition laws, banking laws, bankruptcy laws, and dispute resolution systems, GATT)

Regulating financial markets: Include regulation of securities markets and regulation of financial institutions (helps prevent

failures of the financial system; the objectives of securities regulations include three interrelated goals: protecting investors,

creating confidence in the markets, and enhancing capital formation.

REGULATION OF SECURITY MARKETS: Ensuring the fairness and integrity of capital markets:

•Disclosure requirements, directed towards mitigating agency problem –by imposing fiduciary duties of directors; focused on protecting small (retail)

investors, hence the relatively lax regulatory coverage of hedge funds and private equity funds that are marketed only to qualified investors.

REGULATION OF FINANCIAL INSTITUTIONS: Prudential supervision -monitoring and regulation to reduce system-wide risks and to protect

investors as failure of one financial institution can have a far-reaching impact and may result in a loss of confidence. Due to high mobility of capital

across the developed world, shocks in one part of the system can affect the whole system, leading to global contagion.

The cost-benefit analysis of financial market regulations should also include hidden costs. For example, FDIC insurance for banks may provide

excessive risk-taking incentives for banks (a moral hazard problem).