Page 153 - Microsoft Word - 00 IWB ACCA F7.docx

P. 153

Revenue

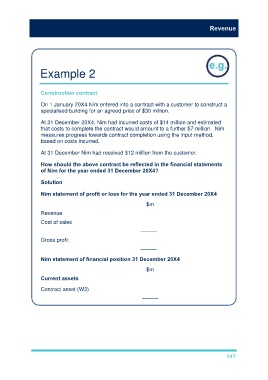

Example 2

Construction contract

On 1 January 20X4 Nim entered into a contract with a customer to construct a

specialised building for an agreed price of $30 million.

At 31 December 20X4, Nim had incurred costs of $14 million and estimated

that costs to complete the contract would amount to a further $7 million. Nim

measures progress towards contract completion using the input method,

based on costs incurred.

At 31 December Nim had received $12 million from the customer.

How should the above contract be reflected in the financial statements

of Nim for the year ended 31 December 20X4?

Solution

Nim statement of profit or loss for the year ended 31 December 20X4

$m

Revenue

Cost of sales

———

Gross profit

———

Nim statement of financial position 31 December 20X4

$m

Current assets

Contract asset (W3)

———

147