Page 160 - Microsoft Word - 00 IWB ACCA F7.docx

P. 160

Chapter 13

Deferred tax

2.1 What is deferred tax?

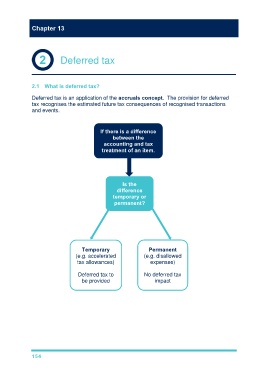

Deferred tax is an application of the accruals concept. The provision for deferred

tax recognises the estimated future tax consequences of recognised transactions

and events.

If there is a difference

between the

accounting and tax

treatment of an item.

Is the

difference

temporary or

permanent?

Temporary Permanent

(e.g. accelerated (e.g. disallowed

tax allowances) expenses)

Deferred tax to No deferred tax

be provided impact

154