Page 164 - Microsoft Word - 00 IWB ACCA F7.docx

P. 164

Chapter 13

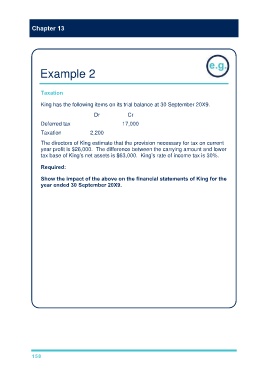

Example 2

Taxation

King has the following items on its trial balance at 30 September 20X9.

Dr Cr

Deferred tax 17,000

Taxation 2,200

The directors of King estimate that the provision necessary for tax on current

year profit is $26,000. The difference between the carrying amount and lower

tax base of King’s net assets is $63,000. King’s rate of income tax is 30%.

Required:

Show the impact of the above on the financial statements of King for the

year ended 30 September 20X9.

Solution:

The tax impact is calculated in three stages (referenced in the answer below):

1 Transfer the figures from the trial balance onto the pro-forma. In this

case the debit balance for taxation forms part of the SPL tax expense for

the year and the deferred tax balance is entered onto the SFP under

non-current assets.

2 Use the figure given for current year taxation to increase the tax

expense in the SPL and create a current liability on the SFP.

3 Calculate the required provision for deferred tax, compare it to the

brought forward figure and account for the movement in SPL expense.

(W1) Provision required for deferred taxation at 30 September 20X9:

$63,000 × 30% = $18,900

158