Page 324 - Microsoft Word - 00 IWB ACCA F7.docx

P. 324

Chapter 24

Chapter 11

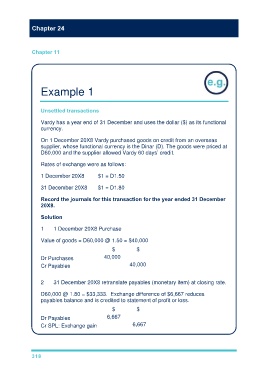

Example 1

Unsettled transactions

Vardy has a year end of 31 December and uses the dollar ($) as its functional

currency.

On 1 December 20X8 Vardy purchased goods on credit from an overseas

supplier, whose functional currency is the Dinar (D). The goods were priced at

D60,000 and the supplier allowed Vardy 60 days’ credit.

Rates of exchange were as follows:

1 December 20X8 $1 = D1.50

31 December 20X8 $1 = D1.80

Record the journals for this transaction for the year ended 31 December

20X8.

Solution

1 1 December 20X8 Purchase

Value of goods = D60,000 @ 1.50 = $40,000

$ $

Dr Purchases 40,000

Cr Payables 40,000

2 31 December 20X8 retranslate payables (monetary item) at closing rate.

D60,000 @ 1.80 = $33,333. Exchange difference of $6,667 reduces

payables balance and is credited to statement of profit or loss.

$ $

Dr Payables 6,667

Cr SPL: Exchange gain 6,667

318