Page 242 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 242

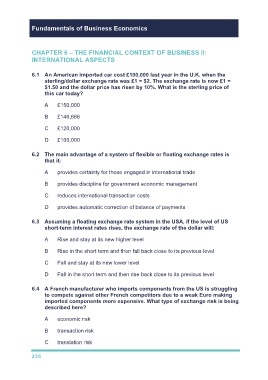

Fundamentals of Business Economics

CHAPTER 6 – THE FINANCIAL CONTEXT OF BUSINESS II:

INTERNATIONAL ASPECTS

6.1 An American imported car cost £100,000 last year in the U.K. when the

sterling/dollar exchange rate was £1 = $2. The exchange rate is now £1 =

$1.50 and the dollar price has risen by 10%. What is the sterling price of

this car today?

A £150,000

B £146,666

C £120,000

D £100,000

6.2 The main advantage of a system of flexible or floating exchange rates is

that it:

A provides certainty for those engaged in international trade

B provides discipline for government economic management

C reduces international transaction costs

D provides automatic correction of balance of payments

6.3 Assuming a floating exchange rate system in the USA, if the level of US

short-term interest rates rises, the exchange rate of the dollar will:

A Rise and stay at its new higher level

B Rise in the short term and then fall back close to its previous level

C Fall and stay at its new lower level

D Fall in the short term and then rise back close to its previous level

6.4 A French manufacturer who imports components from the US is struggling

to compete against other French competitors due to a weak Euro making

imported components more expensive. What type of exchange risk is being

described here?

A economic risk

B transaction risk

C translation risk

236