Page 56 - 5.2 i. Manac Finance ITC Summarised Notes

P. 56

COST OF CAPITAL

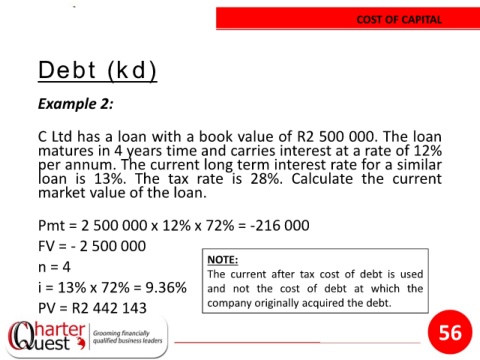

Debt (kd)

Example 2:

C Ltd has a loan with a book value of R2 500 000. The loan

matures in 4 years time and carries interest at a rate of 12%

per annum. The current long term interest rate for a similar

loan is 13%. The tax rate is 28%. Calculate the current

market value of the loan.

Pmt = 2 500 000 x 12% x 72% = -216 000

FV = - 2 500 000

n = 4 NOTE:

The current after tax cost of debt is used

i = 13% x 72% = 9.36% and not the cost of debt at which the

PV = R2 442 143 company originally acquired the debt.

56