Page 57 - 5.2 i. Manac Finance ITC Summarised Notes

P. 57

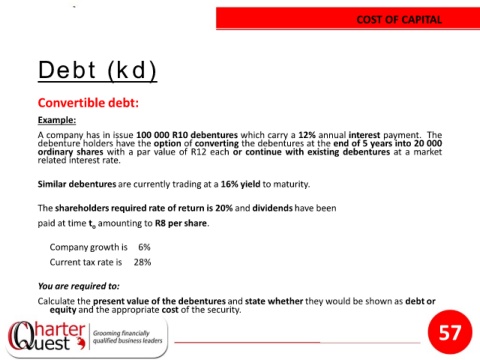

COST OF CAPITAL

Debt (kd)

Convertible debt:

Example:

A company has in issue 100 000 R10 debentures which carry a 12% annual interest payment. The

debenture holders have the option of converting the debentures at the end of 5 years into 20 000

ordinary shares with a par value of R12 each or continue with existing debentures at a market

related interest rate.

Similar debentures are currently trading at a 16% yield to maturity.

The shareholders required rate of return is 20% and dividends have been

paid at time t amounting to R8 per share.

o

Company growth is 6%

Current tax rate is 28%

You are required to:

Calculate the present value of the debentures and state whether they would be shown as debt or

equity and the appropriate cost of the security.

57